Introduction

When looking to scale, most ecommerce companies start to either increase acquisition efforts or develop new products to reach new markets.

When it comes to ecommerce products, the more, the merrier, right? Sometimes, but definitely not always.

While offering more products and developing more products can open your business to wider markets, it can also have devastating consequences.

More SKUs to manage, more time and money spent on research and development and not to mention manufacturing, fulfillment and different shipping and packing protocols.

Adding new products to your line seems like a no-brainer. But more often than not, offering more products isn’t the only way to scale your business.

Your default setting shouldn’t be to keep producing, but rather, to sell higher order values and improve your existing products.

Creating higher average order values allows you to sell less often and develop high customer lifetime values.

Here’s how Vrai & Oro, a jewelry brand was able to widdle their SKUs down, increase order values and leverage a smaller product line to reach $2 million in annual revenue.

How Vrai & Oro scaled back their products to increase sales using payment plans

Vrai & Oro was founded in 2014 out of Los Angeles, California by Vanessa Stofenmacher.

With a background in graphic design, communication arts, and general design, Vanessa was passionate about building small businesses and creating identities for startups.

With expert level qualifications in branding, she had a passion for developing logos and marketing materials.

But that wasn’t her only passion. Jewelry was one of her biggest passions. But she noticed that the typical mass market for jewelry was terrible.

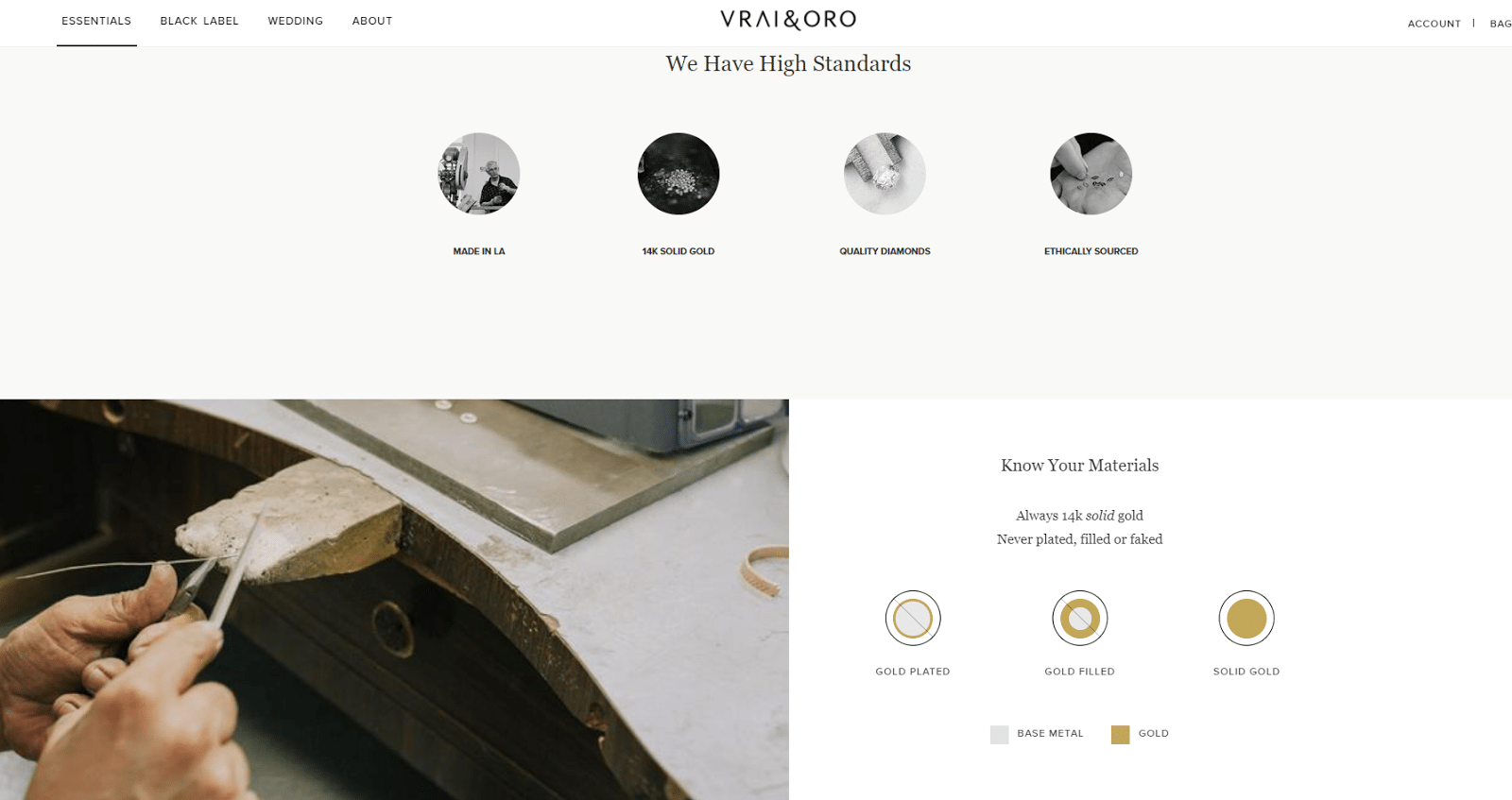

Noticing that jewelry was one of the least transparent markets, she sought to bust through that barrier, creating a company that focused on three core values:

- Quality – the best craftsmanship possible

- Simplicity – of the designs and business model

- Transparency – no phony “best deals” or marketing gimmicks

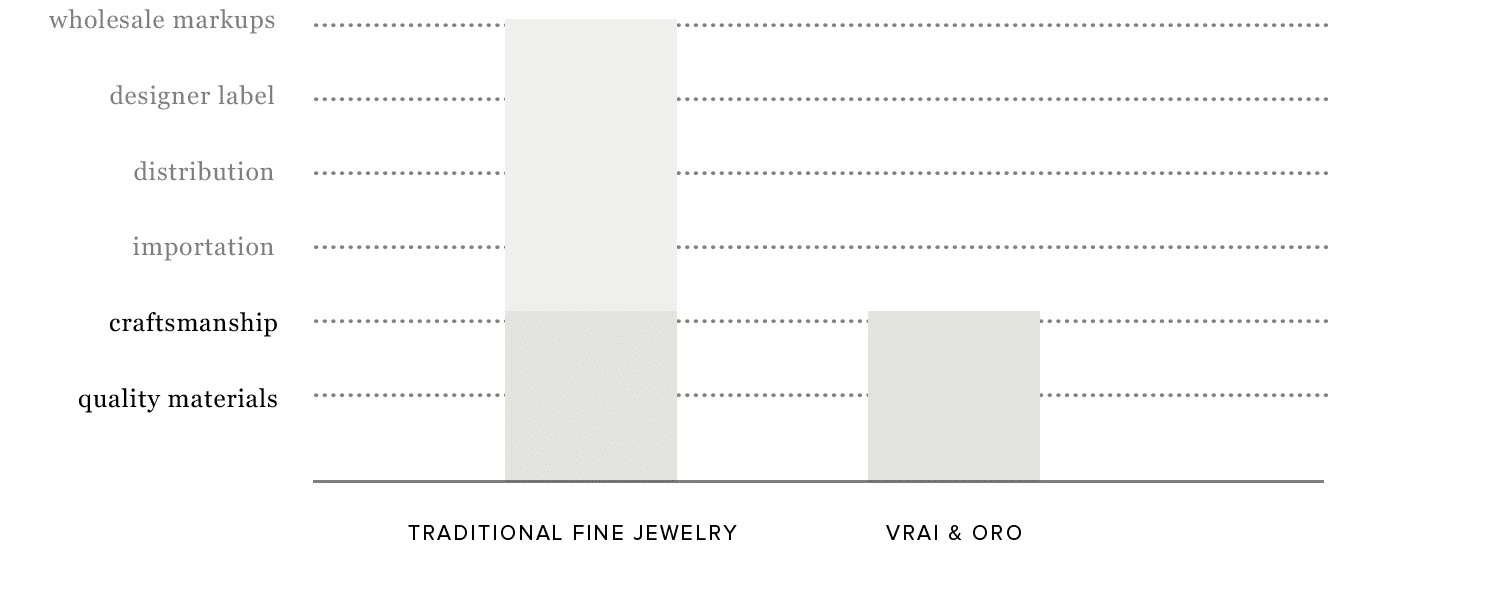

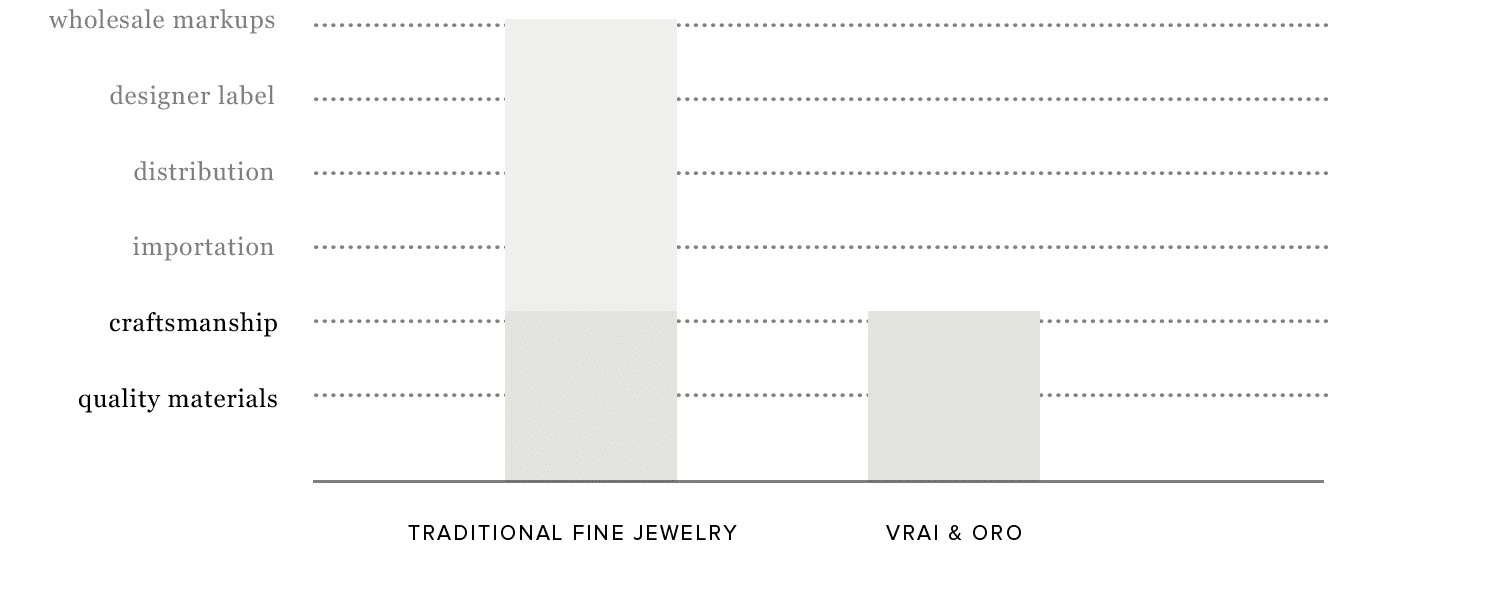

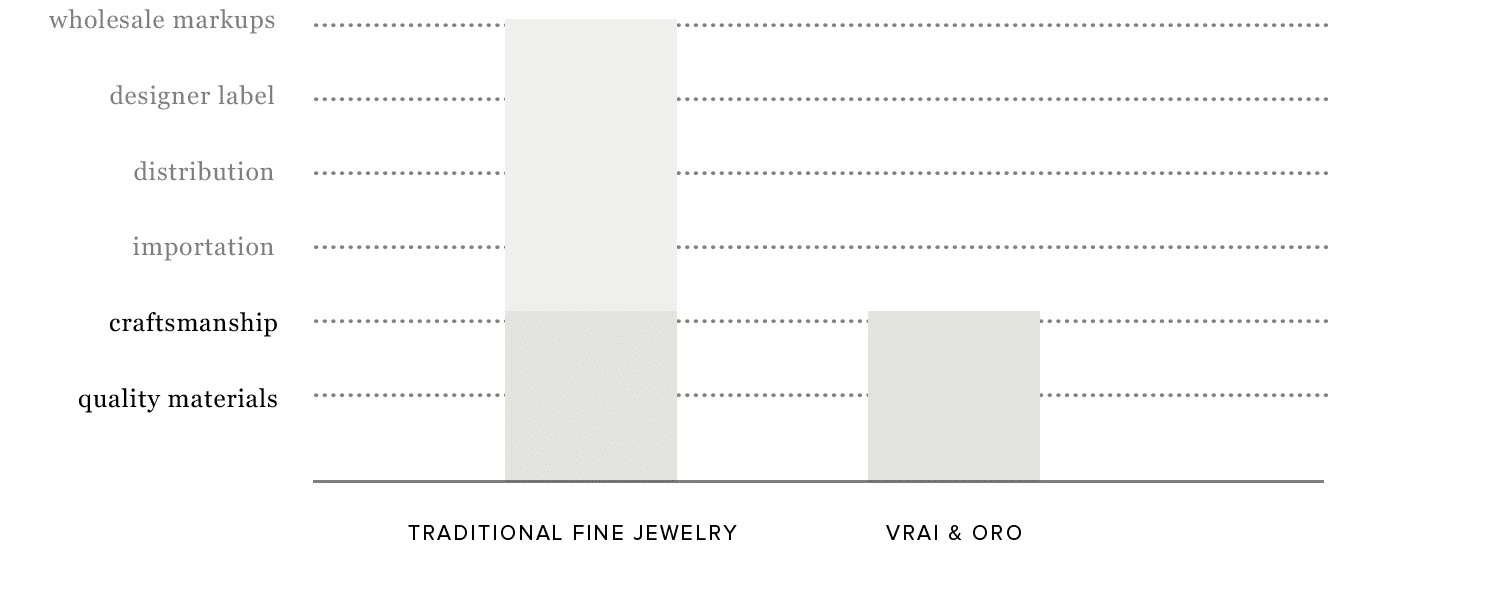

The special nature of her business eliminates the need for wholesale markups, designer labels, expensive distribution, and importation.

Focusing on the best materials and craftsmanship and eliminating the junk in between helps her get the best deals for her customers.

Vanessa was no stranger to the industry. After years of experience and being a customer, she noticed that most “designers” and companies were simply taking pre-made items out of mass-produced catalogs and having them produced under their own brand, and then proceeding to mark the price up 8-10x.

She wanted to create a more consumer-focused model that was able to cut prices.

In the process of doing this, Vanessa virtually eliminated tons of her products and SKUs. Instead of trying to use hundreds of products and confusing navigation options, she focused on simplicity.

Why? In a market like jewelry, there are too many options. It’s nearly impossible to pick, and that often means it takes longer to convert.

It’s like going to a restaurant that has a 50-page menu. It takes you double if not triple the time to pick.

This idea of too many choices was actually proven by a landmark study from The New York Times.

The polarizing study took place in a gourmet supermarket in California, where researchers had assistants set up booth samples of jam. In the study, they tested the idea of more choices being better.

Taking two shifts, they would randomly change every few hours from 24 jams to sample to only six jam samples.

Here’s what the data found:

40% of people stopped by the table with six jam samples, while 60% stopped for the assortment of 24 samples. But, when it came down to converting, 30% of those who stopped to sample the six jams converted, and only 3% converted when sampling 24 jams.

Why? Too many options! There were simply too many choices. The decision to buy wasn’t simple enough, causing people to overthink and lose momentum, ultimately ending up with no purchase.

Vanessa put this to the test with her own company, offering less products and focusing heavily on creating higher order values. Using Affirm, she can drive up order values by opening the door to financing options.

Using a payment plan with fewer products allows her to drive up typical sales and customer lifetime value.

Now, her company generates two million in annual revenue each year.

Here’s how you can set up a payment plan on your own site and weed out products that don’t convert to sell more with less.

How to set up a payment plan on your site and generate more revenue with fewer products

Setting up a payment plan can open the doors of your business to those who can’t afford your products outright, or simply want to pay in chunks, rather than up front.

Here’s how to evaluate your current products, create a structured payment plan, use Affirm to launch it and how to upsell customers to put it to full use.

Step 1. Evaluate your current product offering

Sometimes, offering too many products is counterintuitive.

But it’s often a first step taken when looking to expand a brand. More products = more interested markets = more sales. Right? Well, that’s the theory behind it, at least.

But more products doesn’t mean easy sales. In fact, it means the opposite in most cases.

New products require tons of time and money spent on development, shipping and inventory modification and everything from design to end-product in the customers’ hands.

On top of that, studies show time and time again that too many choices are bad.

The reality is, more choices have become the norm. It can be seen almost anywhere. From Amazon’s endless choices to restaurants having phonebook sized menus.

And this has lead to a psychological concept known as decision fatigue. According to Wikipedia, it “refers to the deteriorating quality of decisions made by an individual after a long session of decision making.”

Essentially, as decision making gets more complex, people start to lose steam and motivation. And when someone loses traction during the buying process, they end up leaving the sale. It’s simply too much work.

The moral of the story is:

Eliminate products that don’t sell as well as others.

If you have 20 products but 90% of your sales come from five products, why are you wasting time and resources on the other 15?

You are likely losing money by having those products and paying for their expenses, inventory and listing space.

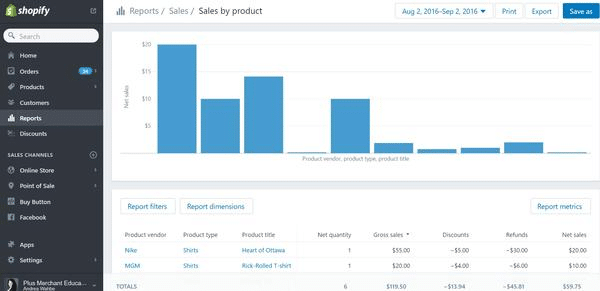

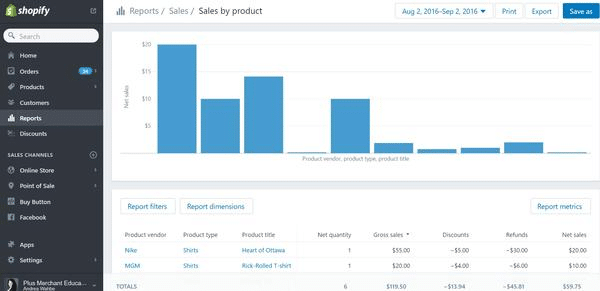

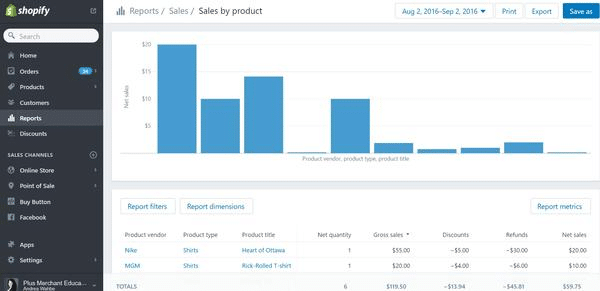

If you run Shopify, you can locate your “Sales by product” report to see what products are selling and which aren’t:

Locate any products that don’t sell well and do a cost-benefit analysis.

Ask yourself key questions like:

How much does this product take to produce, keep on shelves in inventory and list on your site? Do only a few orders a year go out for it? If so, consider eliminating it.

Studies show that fewer choices result in faster decision making. Don’t bog down customer choices for a product that isn’t selling.

Instead, you can put more time and effort into marketing and building up existing products.

Step 2. Create a structured payment system

Creating a payment plan system can help you sell to more people and increase the order value of each sale.

By appealing to those who don’t want to (or can’t) spend $500 or $1,000 on a single purchase, you can land more sales. And since the cost is financed, you can even upsell them.

Creating a structured plan should focus on how much you are going to charge, and how the cycles work.

For example, let’s say you have a product worth $1,000. Do you sell the payment plan as ten payments of $100, or four payments of $250?

Is $250 too high per payment? Maybe. But splitting it into ten payments means you won’t get paid as fast.

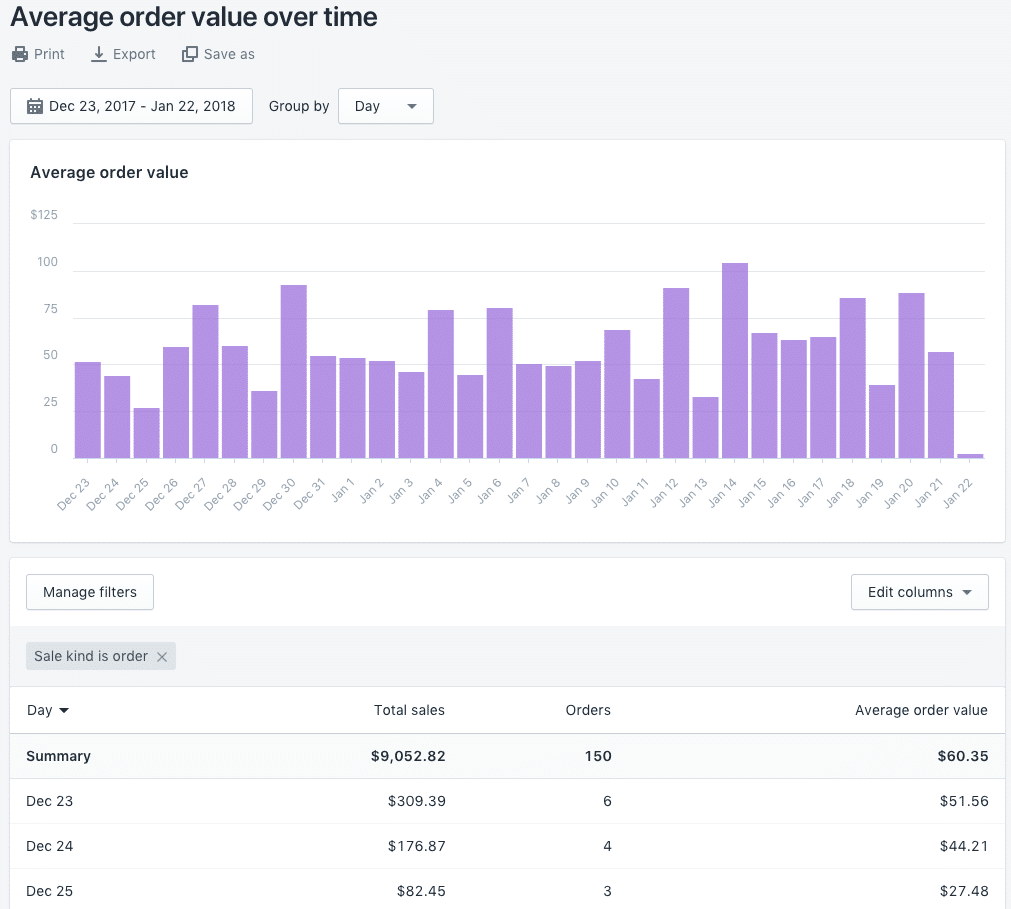

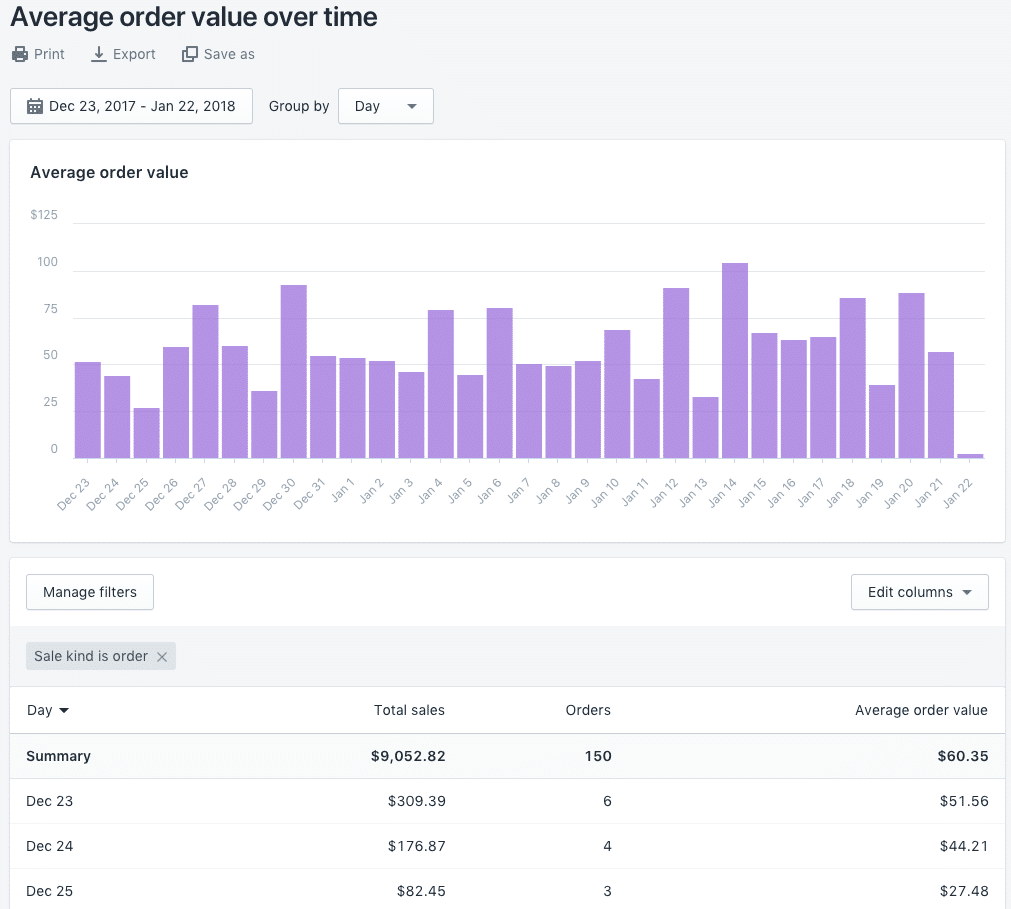

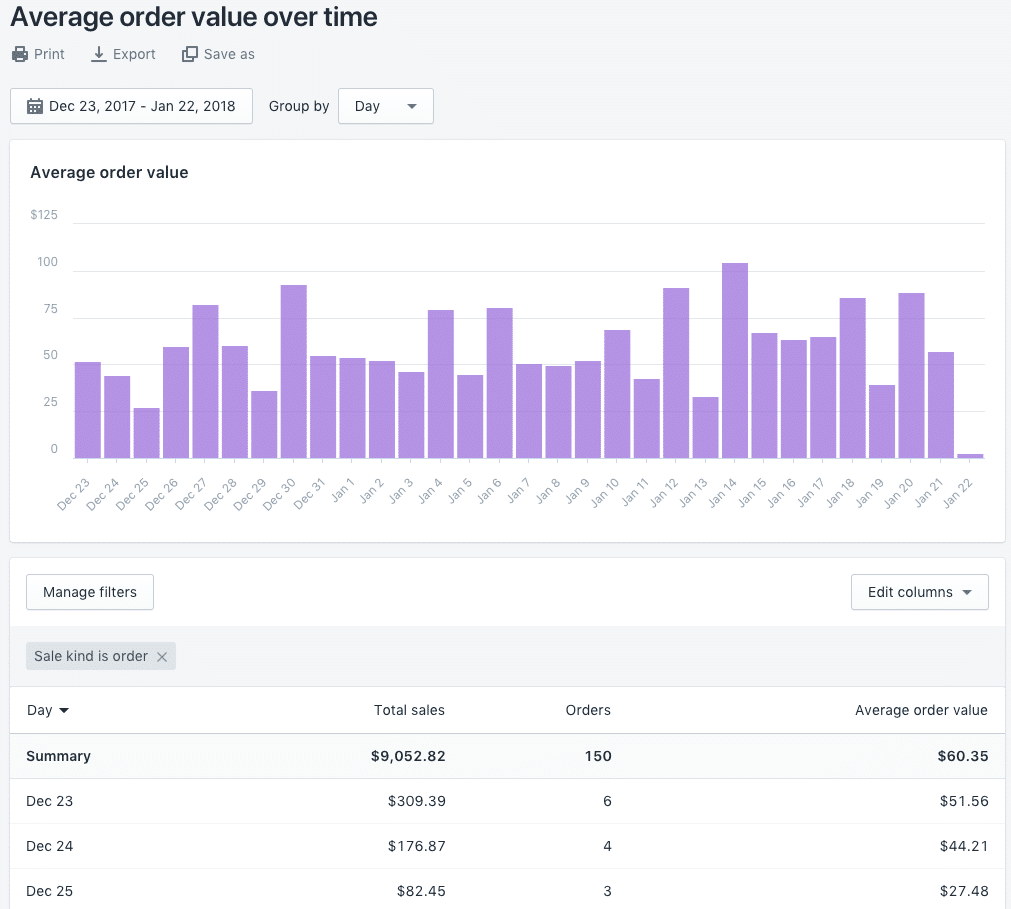

Both have their pros and cons. A great way to decide on payment structures is by looking at your average sale/order values over time.

Using this report, you can see what your average customer is spending each time. Meaning you see what the average person is willing to pay upfront for a given sale.

This is a good starting point to inform your payment plans. For example, if your average order value is $250, you know that people are willing to pay that upfront.

This means you can actually develop two options:

- A plan that does payments of $250 (depending on the price).

- A plan that does half of your average order value.

You can simply divide that in half and charge in payments of $125 until they reach the end value of each product.

Step 3. Set Up a payment plan option with Affirm or Blispay

Currently, Vrai & Oro use Affirm, a payment financing system that takes care of most the tough back-end work involved with setting up payment plans for customers.

Affirm works with almost all ecommerce platforms, from Salesforce Commerce Cloud to Oracle, Magento, Shopify and more.

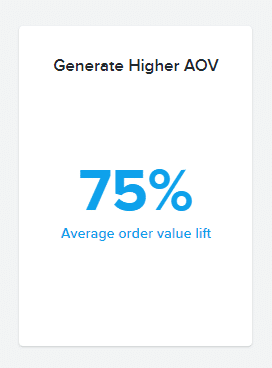

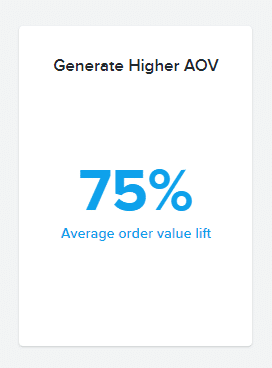

Affirm boasts some serious credibility, stating that they can increase average order values by 75% on average.

They also guarantee a 20% increase in conversions and a better Net Promoter Score, indicating your customers will be satisfied.

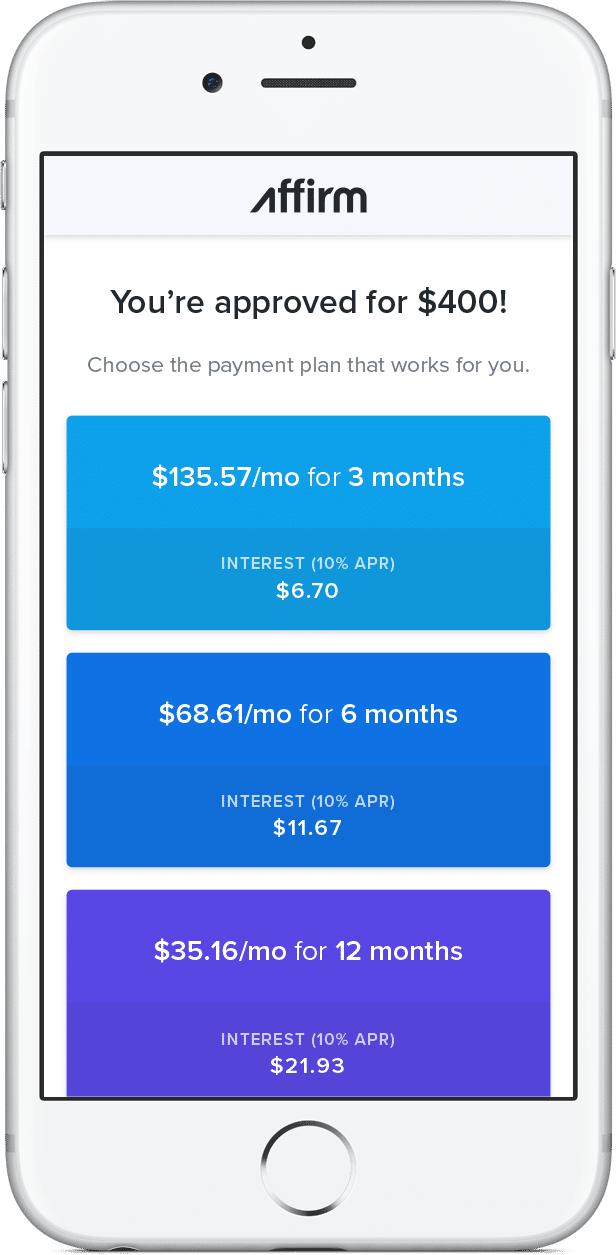

If you choose to use a payment platform like Affirm, you can use their own customized payment pricing plans, or institute your own:

Another jewelry store, SuperJeweler, uses Affirm to boost their growth and average order volume.

According to their case study, their average order size increased by 600% when adding a payment financing option.

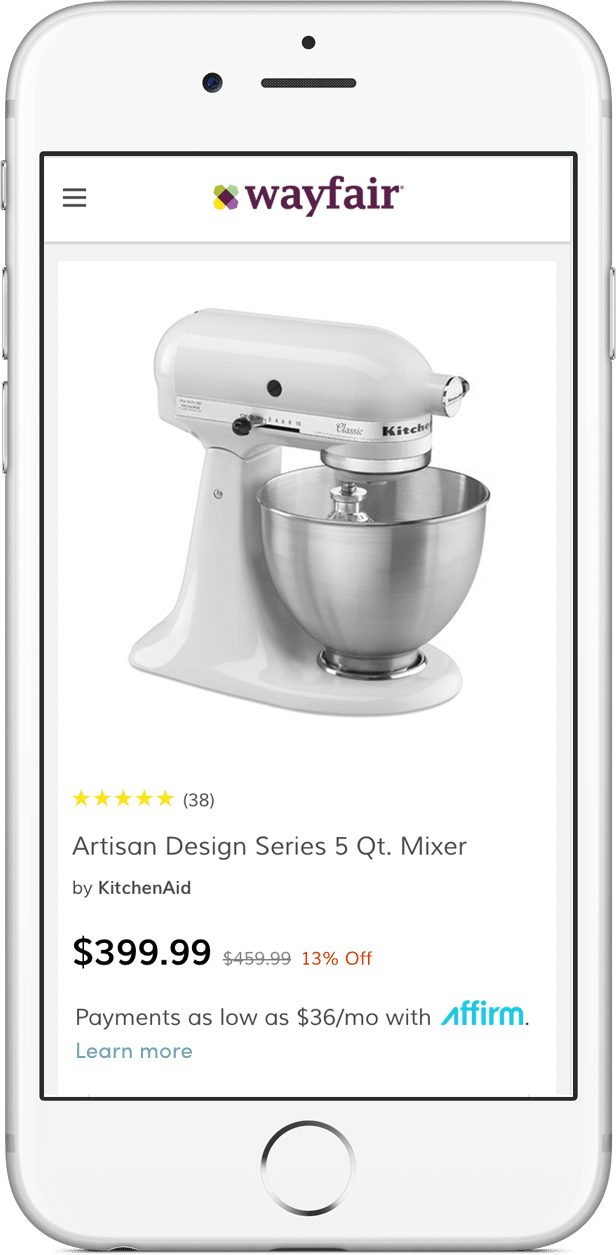

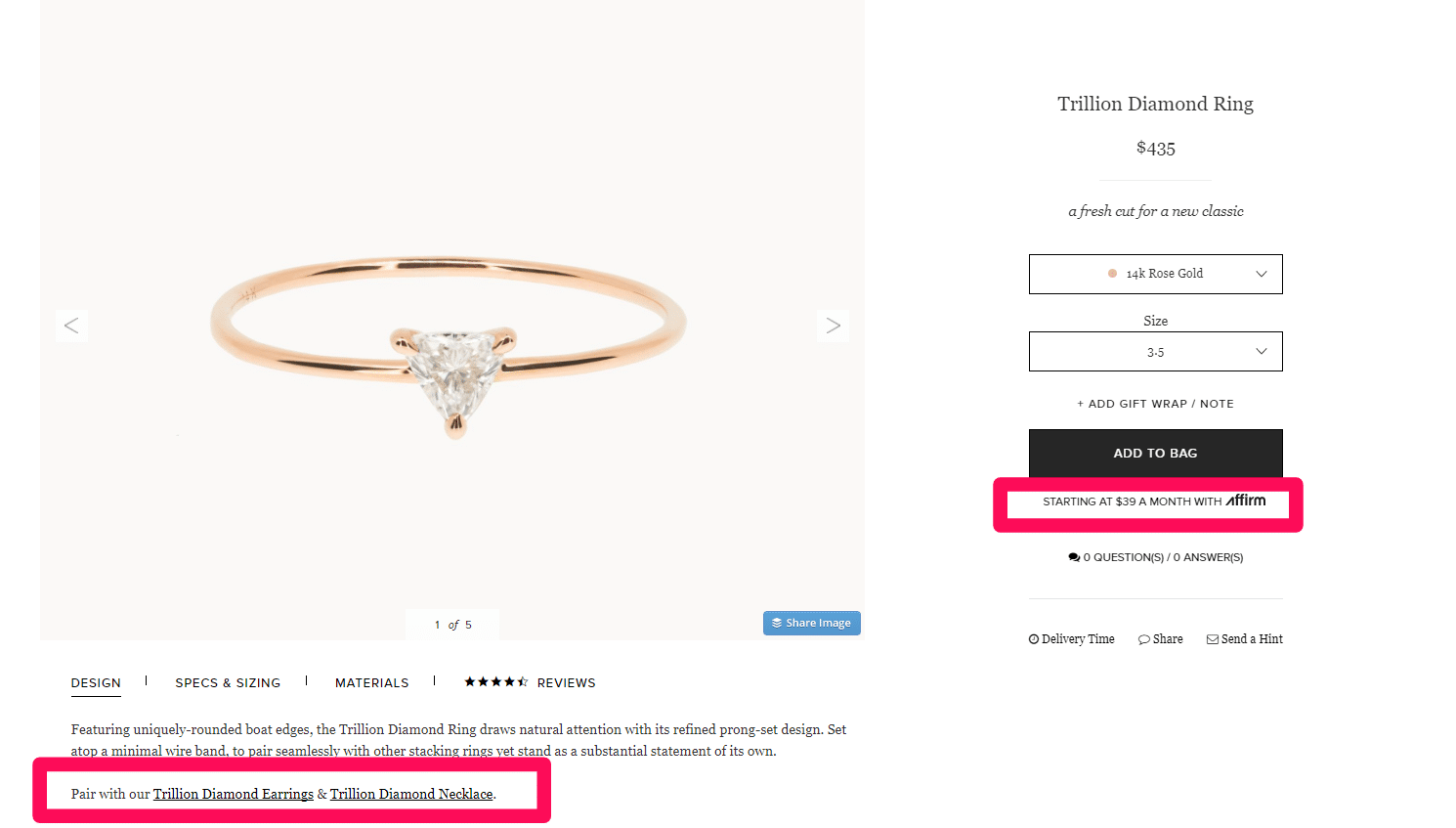

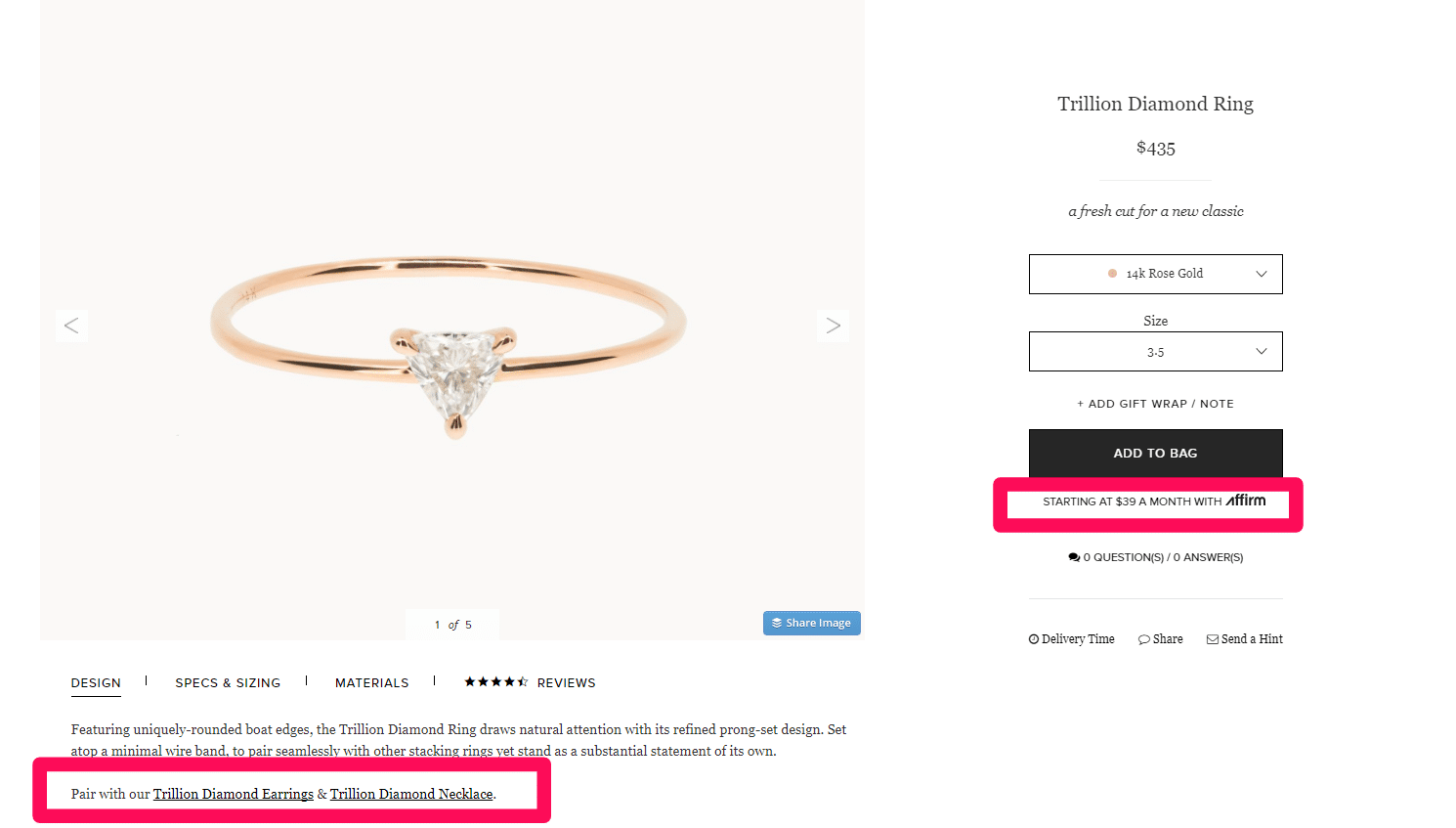

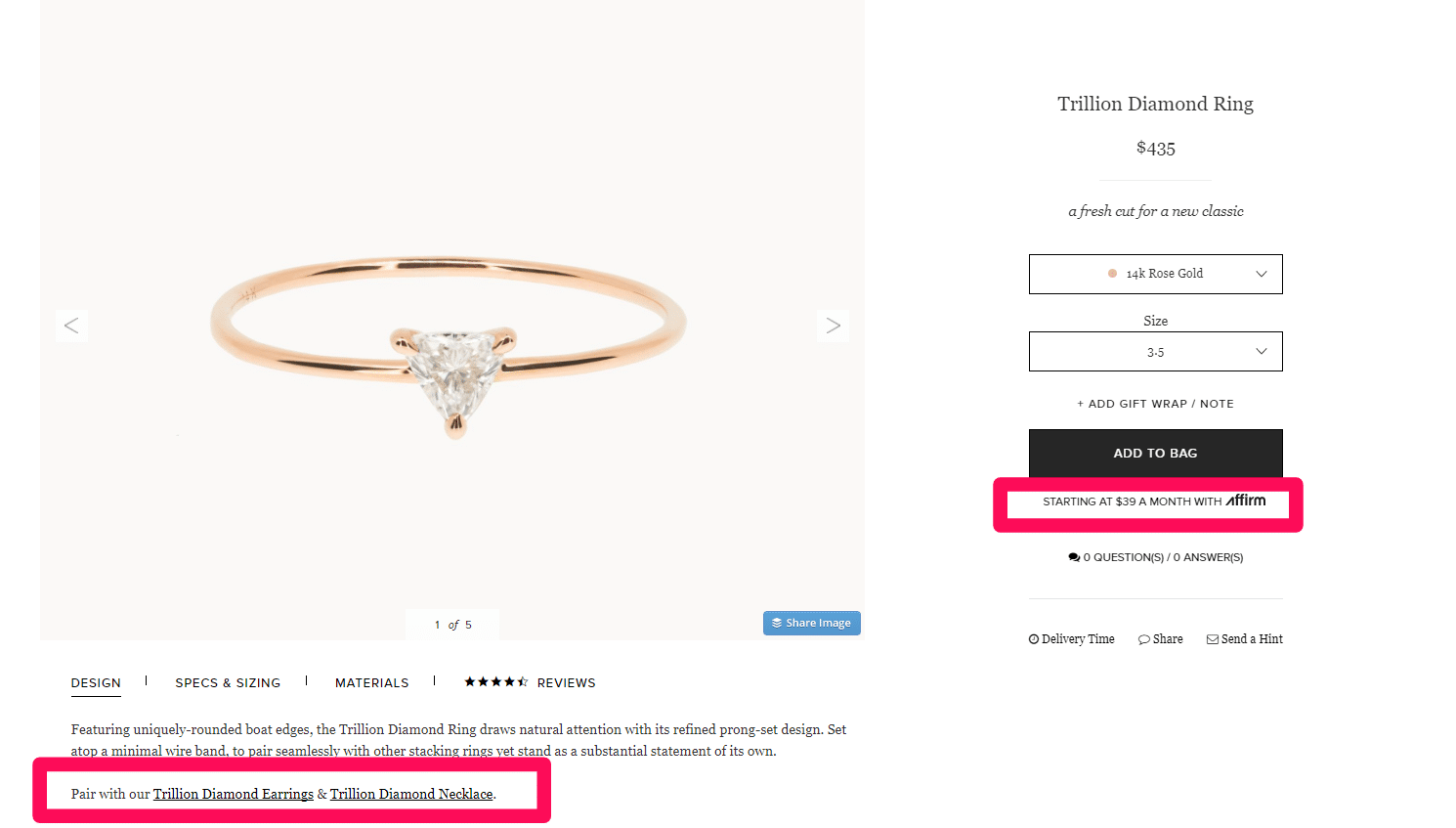

Affirm is very simple. On each of your product pages, Affirm will show up just below your pricing, telling customers how they can finance it:

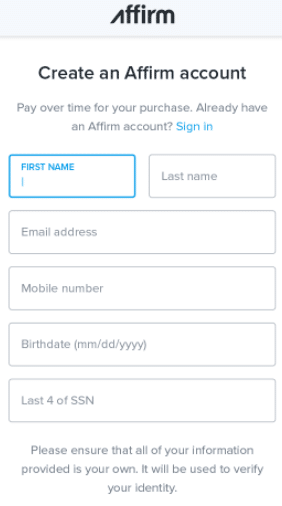

When users click on the Affirm offer, they get prompted to create a new account:

Once they’ve chosen a payment plan, they must apply using their credit score to get approved for specific financing and interest options.

Depending on their approval, the price will be more or less expensive due to interest.

Another payment provider is Blispay. With a no-cost setup and no additional costs beyond credit card fees, they are a great option to evaluate.

Both of these tools can help you set up payment plans fast to get your new strategy off the ground.

They eliminate the need to worry about payments or managing them. With financing rates, they can calculate plans for your business and assess what the best pricing methods are.

Try using one for your business today to get your payment strategy up and running.

Step 4. Upsell customers to increase your order value

Most people in America don’t have massive savings, if any at all.

It’s a sad reality, but it’s true. And that means that purchasing products with high value is tough!

It’s often not possible to buy a $500 ring or a $2,000 necklace outright. When you are selling big ticket items like jewelry or technology, not everyone can afford it upfront.

This is where your business comes in. Financing is a critical step in getting more customers.

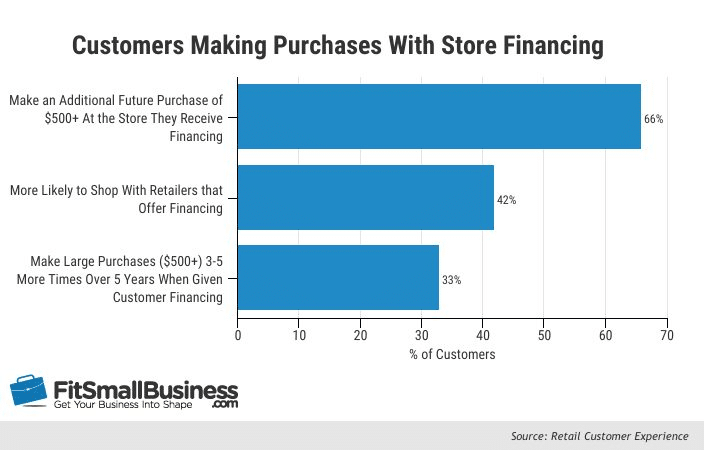

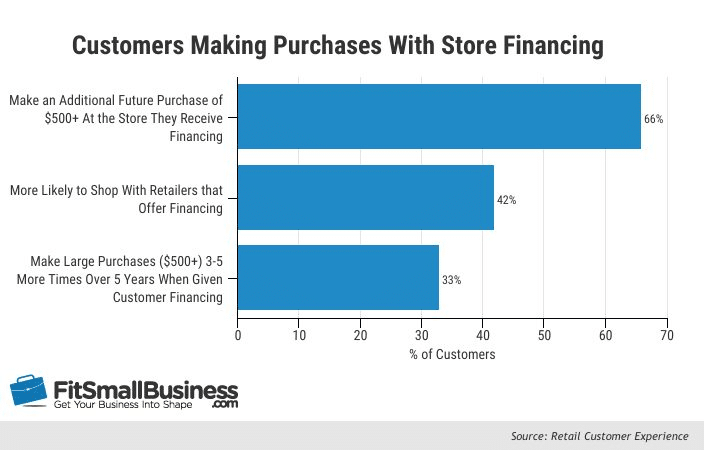

The latest data shows that customers who purchase using store financing actually spend more money and are more likely to continue shopping with that business:

Order values for companies using finance plans can increase by as much as 120%.

Not only does it build high order values, but it instills loyalty and builds a customer base that continues ordering with you.

Financing can open doors for your business and sales. Vanessa has used it to generate a recurring revenue of $2 million.

And when you are competing with larger companies like Vanessa was, it’s a must. Top jewelry stores with a brick and mortar presence offer financing. The same goes for just about any industry selling high-value products. From mattresses to TVs and computers.

Make sure that your financing options are transparent and easily visible:

On Vrai & Oro’s product pages, you can quickly start a monthly payment plan using Affirm:

On top of offering the easy payment options on each product, they upsell customers, knowing that financing can increase order values.

Using the related products sell point, they can get users to throw in additional products that others buy.

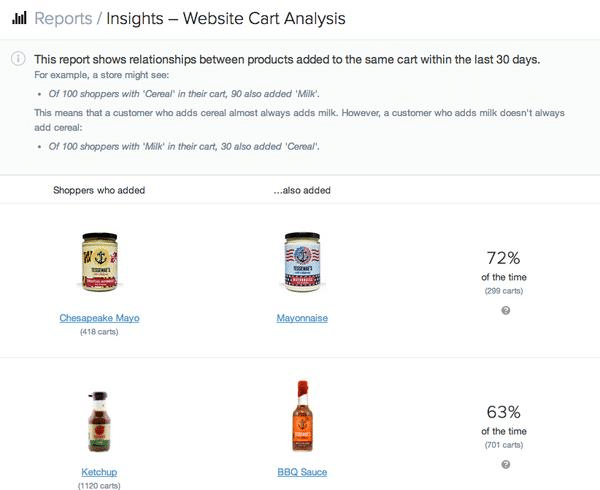

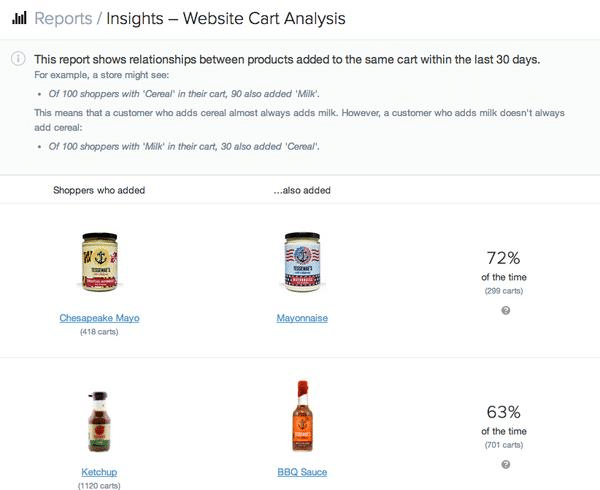

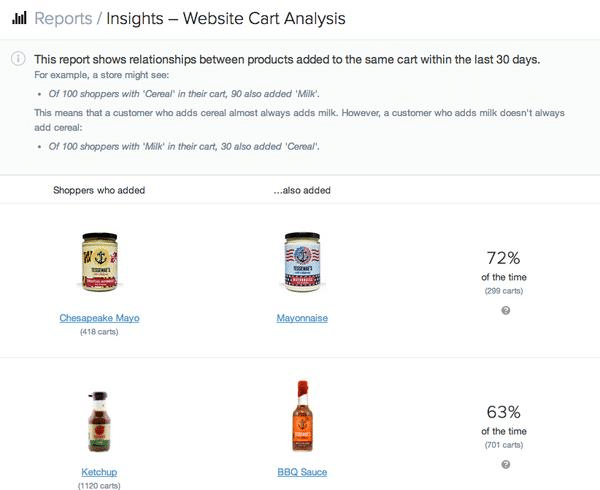

A great way to upsell customers is using the “people also added” feature that you see on Amazon’s product listings. Using Shopify, you can analyze your “Website Cart Analysis” report to find products that people often lump together:

Use the same strategy that Vrai & Oro uses to add related items to a suggestion box on your products.

It’s an easy way to quickly add more products to an order.

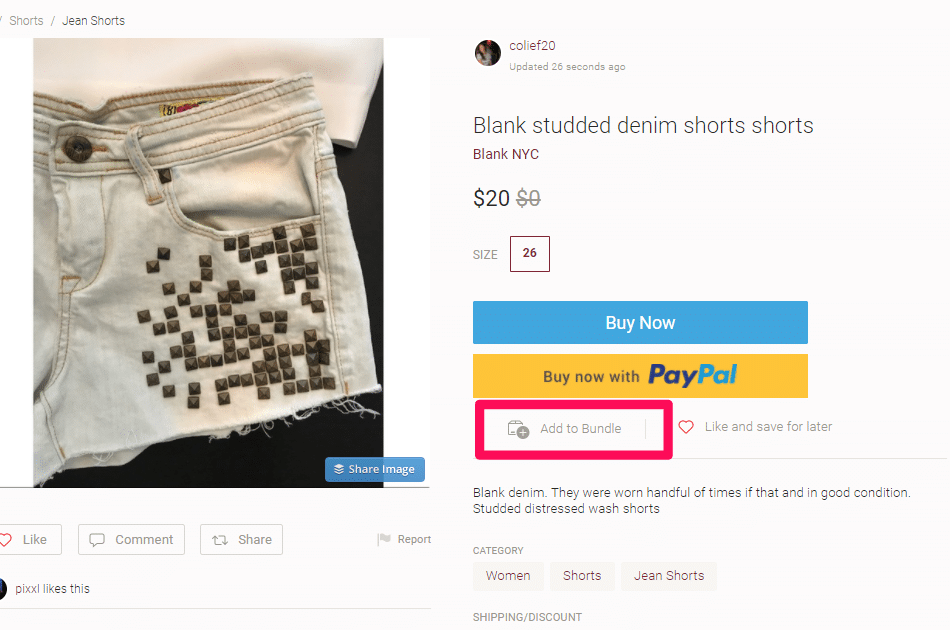

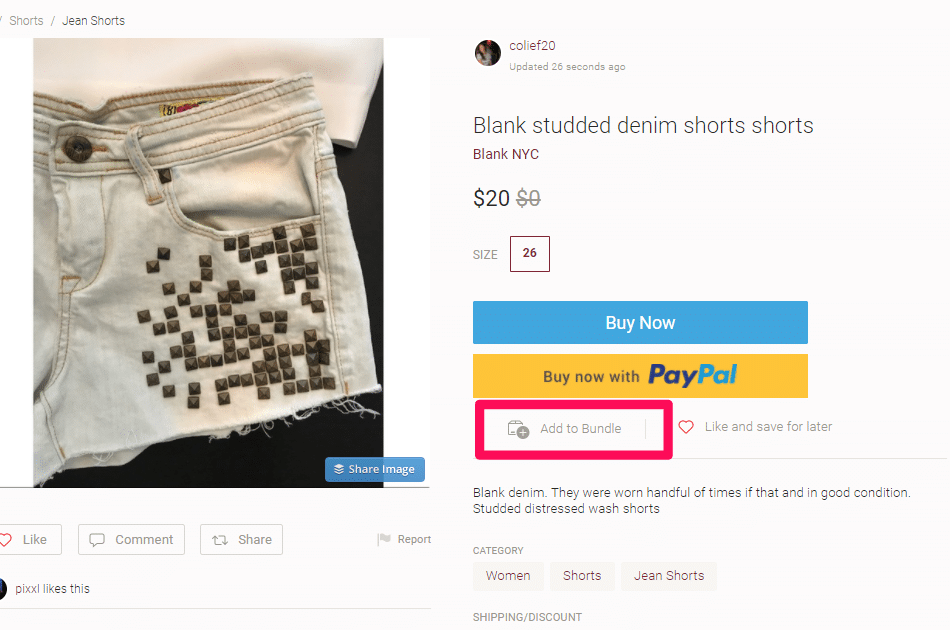

Another strategy to consider is creating bundles of your products. For example, Poshmark allows users to add products to their bundle, which in turn provides a small discount to incentivize it:

When adding a product to a bundle, your total cost for each item drops, but you also increase order values in total by selling a product that you might not have sold without it.

Try adding a bundle feature or package deals that can help you increase the sale value when someone uses payment plans.

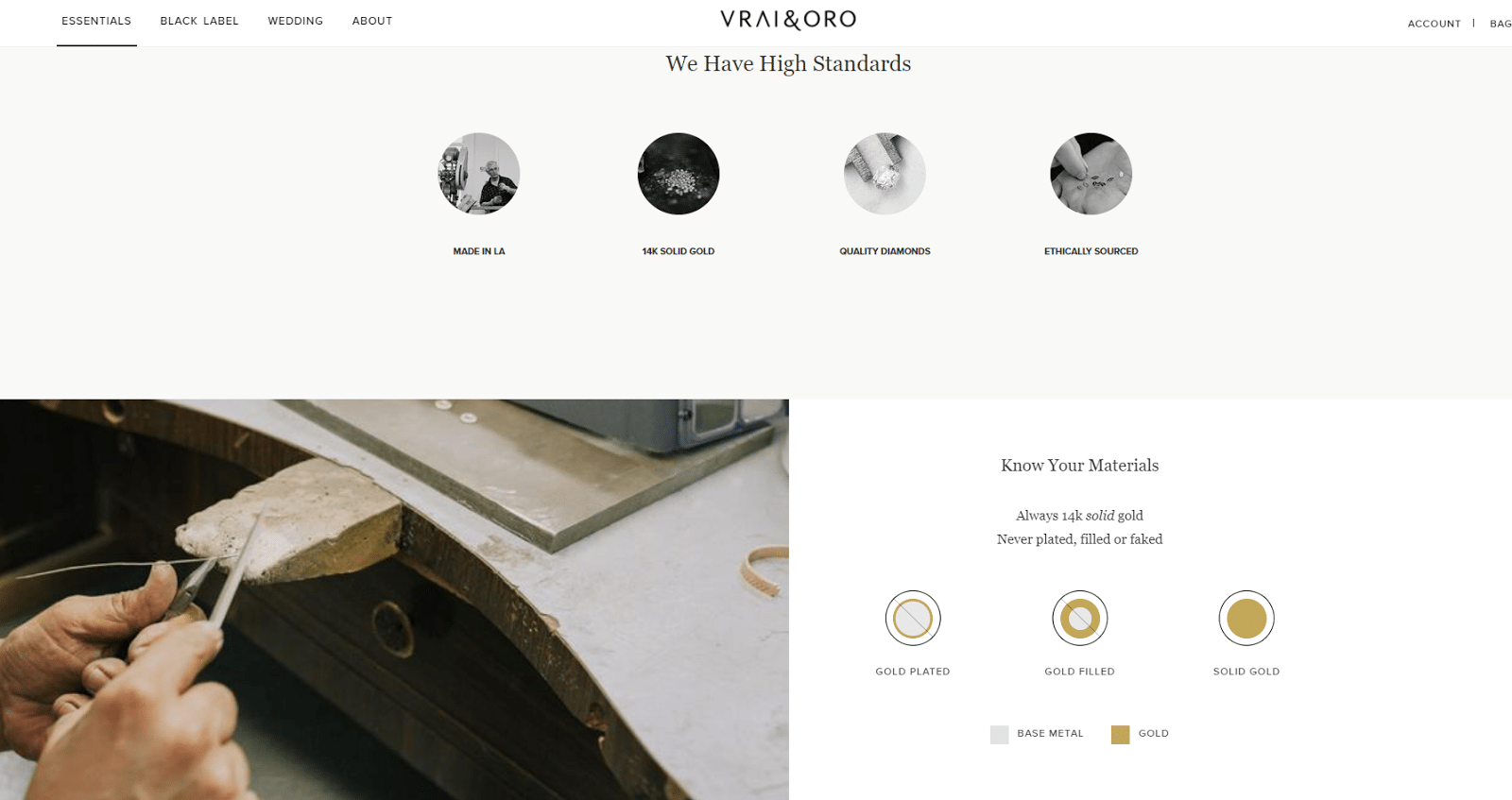

Additionally, Vanessa makes sure that her brand feels premium and worth the trouble of financing:

Her premium, high-quality jewelry is accessible to anyone using the payment plans. Meaning even if someone can’t initially afford a high price tag, the option is available to them if they need it.

When using financing, always try to upsell customers. You can offer fewer products and drive up average order values instead. Meaning you need fewer customers and you will spend less money on acquisition.

Recap: TL;DR

When it comes time to scale a business and drive more revenue growth, the first step most people take involves acquisition or product development.

But often, that’s a mistake. Studies show that too many product options cause fatigue in the decision-making process.

Vrai & Oro took that data and turned it into a living success. Eliminating tons of SKUs and products that people weren’t buying, they were able to simplify their offering.

To compensate for fewer products, they added financing payment plans to their site, allowing users to pay in multiple months, rather than upfront.

This opened the door for more sales and a recurring revenue in the millions.

And the great news? It’s achievable for any business.

First, take a deep look at your products and which ones are bogging you down. If they aren’t selling, eliminate them. Next, create a payment plan structure that fits your business plan. Try using a payment system like Affirm or Blispay to take care of the financing. Lastly, be sure to always upsell customers.

Data shows that financing can increase your order values. Always link related and featured products on each product SKU to increase order sizes.

Now It’s Your Turn

Using a payment plan can help you drive up order values. Make sure to simplify your offerings.

Now it’s your chance to produce higher sales.

What payment plans are you going to install? What products are going to be your focus?

Comments